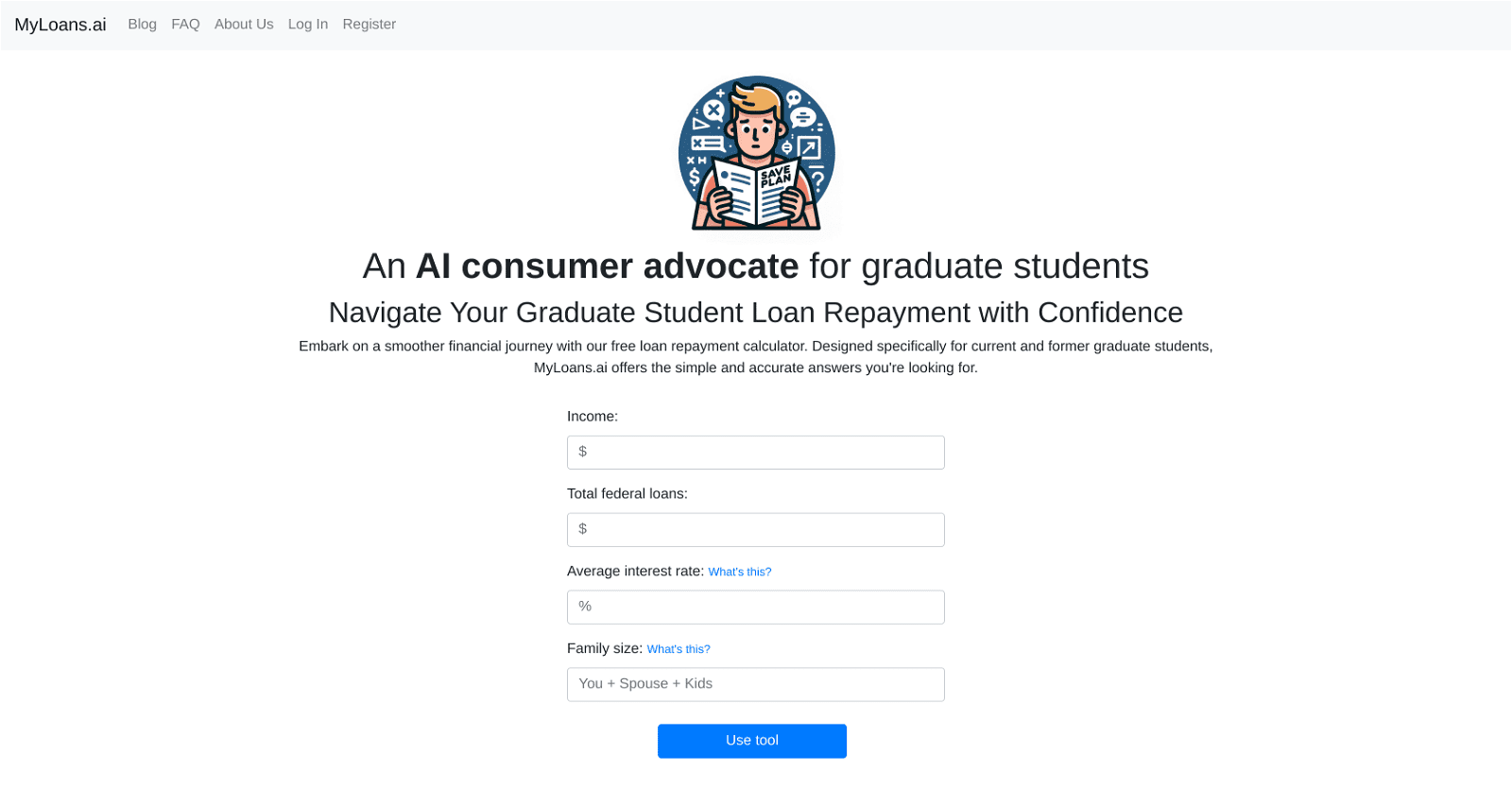

MyLoans ai is a specialized AI-powered tool dedicated to supporting graduate students in confidently navigating the complexities of loan repayment. As an AI consumer advocate, MyLoans.ai is uniquely designed to assist both current and former graduate students throughout their financial journey.

Central to the platform is a complimentary loan repayment calculator, offering a streamlined and precise approach to managing student loans. By considering key variables such as income, total federal loans, average interest rate, and family size, this calculator generates personalized repayment plans tailored to each user’s unique circumstances.

In addition to the calculator, MyLoans.ai provides comprehensive support and addresses user inquiries regarding student loan repayment. With a commitment to offering insightful guidance, the platform empowers graduate students to effectively manage their loans and take charge of their financial future.

More details about MyLoans

Is MyLoans ai free to use?

Absolutely! MyLoans ai is completely free to use, providing users with access to a comprehensive loan repayment calculator designed to simplify the management of student loans.

Can I receive a personalized repayment plan on MyLoans ai?

Yes, MyLoans.ai generates tailored repayment plans for each user, considering individual factors such as income, total federal loans, average interest rate, and family size. This ensures personalized financial guidance suited to each user’s unique circumstances.

How does MyLoans ai assist with loan management?

MyLoans.ai aids in loan management through its advanced calculator, which creates personalized repayment plans. Additionally, the platform offers support and answers to user inquiries, serving as a consumer advocate to empower users in effectively managing their loans.

Is MyLoans ai specifically for student loans?

Yes, MyLoans.ai is specifically designed to manage student loans, catering exclusively to the needs of graduate students. It does not extend its services to other types of loans.