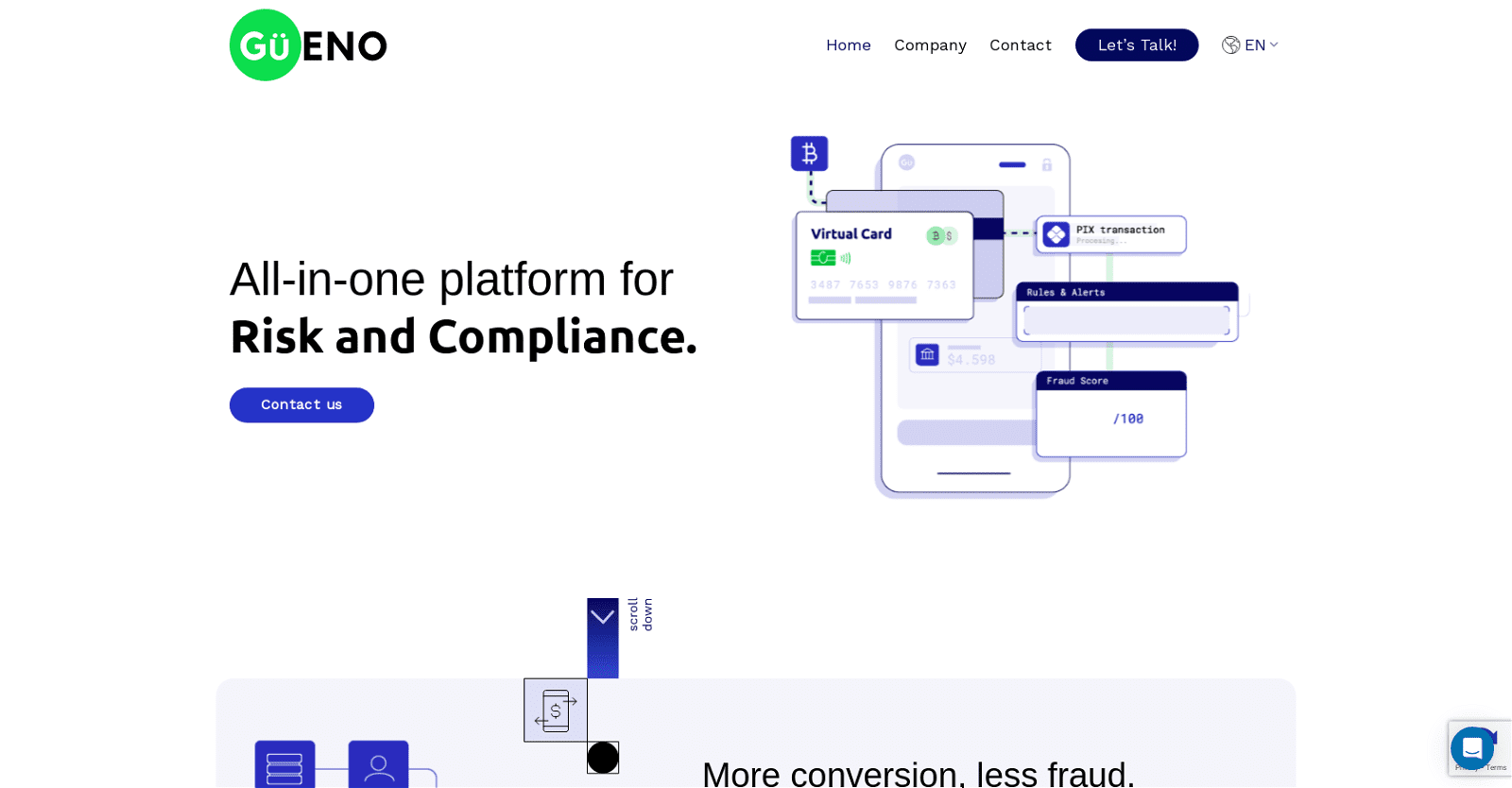

Güeno EN stands out as an all-encompassing platform tailored for risk management and compliance, strategically engineered to optimize conversion rates, curtail fraud, and uphold regulatory standards.

At its core, the platform excels in orchestrating, automating, and predicting transactional behavior by amalgamating data from both external sources and internal systems. Its paramount objective revolves around monitoring users and transactions, diligently adhering to local regulations while fortifying defenses against fraudulent activities.

Equipped with a robust suite of features, Güeno EN simplifies risk management and compliance procedures. It seamlessly automates end-to-end internal rules and supports a gamut of validations, including Know Your Customer (KYC), Politically Exposed Persons (PEP) screening, adverse media checks, Anti-Money Laundering (AML) screenings, and government and local screenings.

Additionally, Güeno EN boasts transaction monitoring capabilities, adept at scrutinizing both fiat and cryptocurrency transactions. From BIN checks to income verification and AML screenings for fiat and crypto addresses, the platform leaves no stone unturned in ensuring transactional integrity.

Notably, Güeno EN’s fraud prevention engine harnesses the power of artificial intelligence to preempt and combat fraudulent activities across fiat and Web3 environments. By vigilantly monitoring user behavior, it swiftly identifies potential threats such as account hijacking, bot infiltration, and screen-sharing anomalies.

With an API-first approach, Güeno EN offers a single API for real-time monitoring and fraud prevention, facilitating seamless integration and swift operational deployment. Numerous success stories underscore how Güeno EN has empowered companies to surmount regional challenges associated with onboarding, fraud mitigation, and compliance monitoring across various digital landscapes, spanning Web2 and Web3 realms.

In essence, Güeno EN emerges as a potent ally for organizations seeking to streamline risk management and compliance endeavors, fortify fraud prevention measures, and uphold regulatory integrity within ever-evolving digital ecosystems.