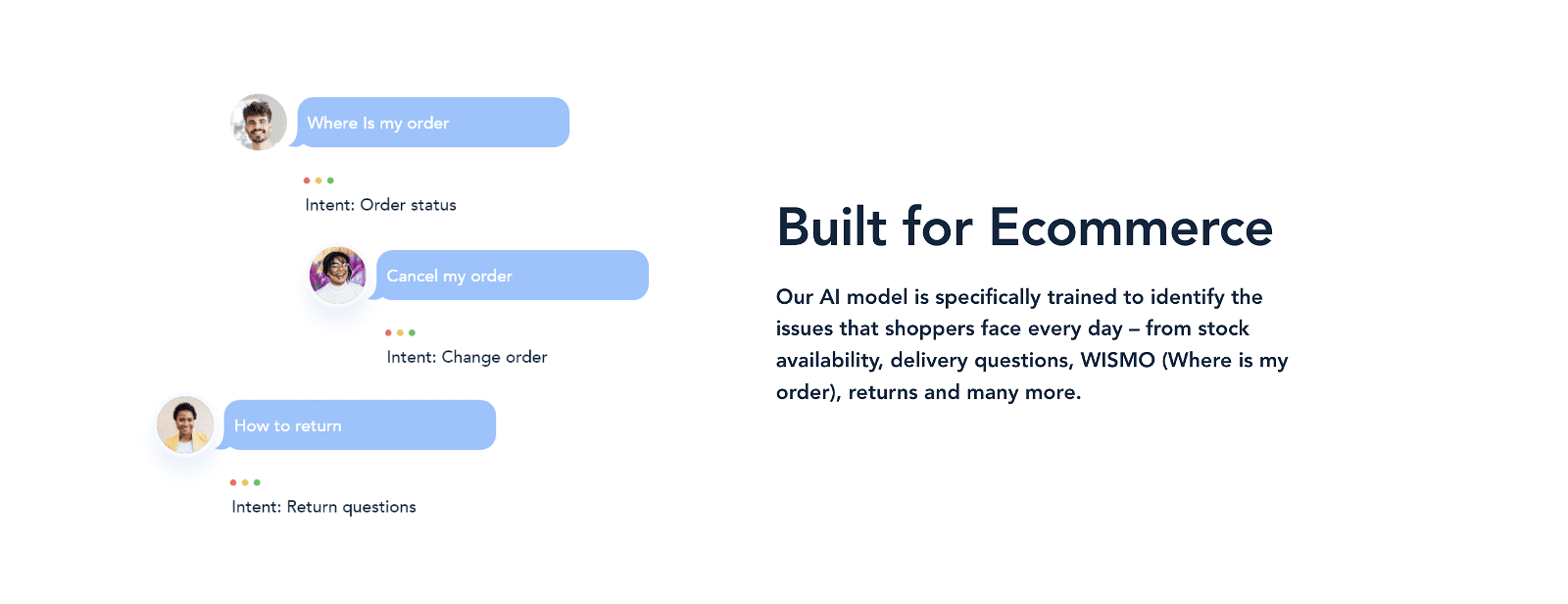

Diligent is an AI-powered tool tailored to streamline and enhance due diligence processes for fraud and Anti-Money Laundering (AML) teams, particularly within the fintech industry. It revolutionizes workflows by automating tasks such as risk investigations on legal entities and reviewing customer documents like registry extracts and proof of addresses. By reducing false positive alerts generated from AML systems, Diligent ensures efficient operations.

At the core of Diligent’s functionality are large language models that automate redundant level one tasks while adhering to specific workflows and policies, guaranteeing a thorough audit trail. Notably, the tool seamlessly integrates into existing systems and vendors, eliminating the need for disruptive changes to current AML/KYC systems.

Diligent boasts a user-friendly interface and offers the flexibility of API integration into internal tools for customized use. With a mission to decrease time and costs associated with risk and AML compliance operations, Diligent enhances risk assessment capabilities and minimizes friction in customer onboarding processes.

More details about Diligent

Can Diligent review customer documents such as registry extracts and proof of addresses?

Yes, Diligent has the capability to review customer documents like registry extracts and proof of addresses. It can efficiently verify business information and validate customer-uploaded documents, thereby reducing friction in the onboarding process.

How does Diligent adhere to specific workflows and policies?

Diligent adheres to specific workflows and policies by leveraging large language models to automate level one tasks. By following your organization’s established procedures, Diligent ensures compliance and maintains a comprehensive audit trail, mitigating the risk of non-compliance in fraud and AML teams’ operations.

What specific tasks can Diligent automate for a fraud and AML team?

Diligent is capable of automating various tasks for fraud and AML teams, including conducting risk investigations on legal entities, reviewing customer documents such as registry extracts and proofs of address, and reducing false positive alerts generated by Anti-Money Laundering systems.

Can Diligent assist with transaction monitoring?

Diligent’s specific capabilities regarding transaction monitoring are not explicitly mentioned in the provided information. For detailed information on Diligent’s features related to transaction monitoring, it is recommended to consult the tool’s documentation or reach out to the provider directly.