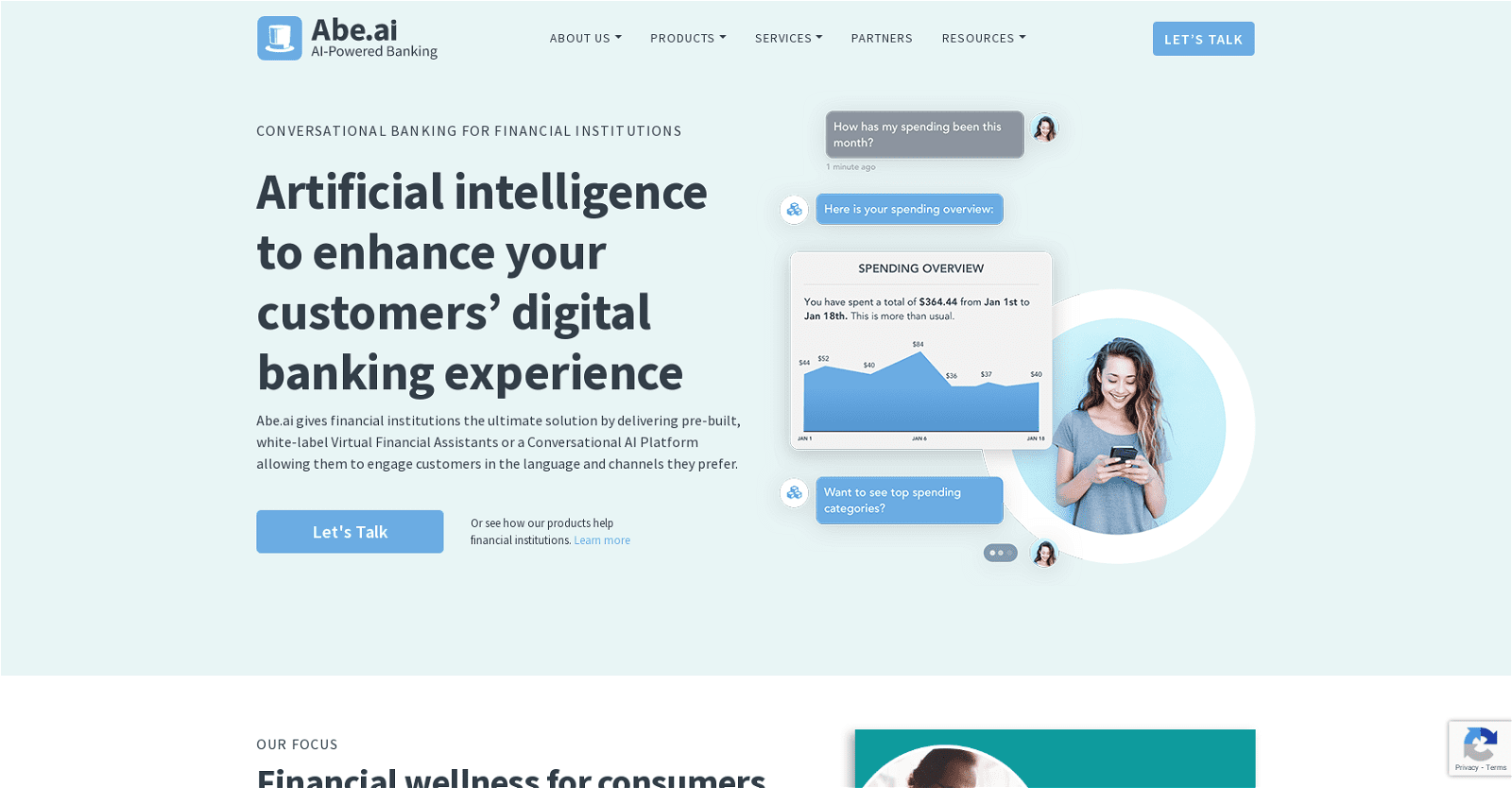

Abe AI offers AI-powered banking solutions for banks and credit unions to provide world-class customer service, streamline operations, and drive profitable growth. The company provides a Virtual Financial Assistant or a Conversational AI Platform that can be customized as per the financial institution’s requirements. This allows them to engage customers in the channels and languages that they prefer, ultimately promoting both customer and operational efficiency.

The Virtual Financial Assistant (VFA) helps in financial wellness for consumers, guiding them with relevant personalized interactions and self-serving capabilities. Similarly, the Conversational AI Platform empowers financial institutions with fully featured products, giving them better customer experiences and increasing operational efficiency.

Abe AI’s technology is built keeping in mind for banks, credit unions, and wealth managers. It provides a personalized Natural Language Understanding and advanced machine learning techniques to create a more engaging dialogue and better language understanding.

Abe AI’s technology can be integrated with existing and new security protocols to ensure secure and private interactions across all channels, making the entire digital banking experience simpler and better. Overall, Abe AI offers a powerful tool for financial institutions to enhance their customer’s digital banking experience while improving their own operational efficiency and data insights.

More details about Abe AI

Can Abe AI’s technology be incorporated with existing security protocols?

Yes, Abe AI’s technology can be incorporated with existing security protocols. The platform is designed to offer secure and private interactions across all channels, leveraging both existing security measures and introducing new protocols to ensure the complete safety and privacy of all customer interactions.

How does Abe AI ensure security and privacy in interactions?

Abe AI ensures security and privacy in interactions by integrating with existing and new security protocols. It provides a secure and private cloud intelligence layer that enables interactions across traditional and non-traditional digital channels. Compliance tracking is also part of its AI model, which trails every interaction all the way back to the model and underlying source data.

In what ways can Abe AI improve customer engagement for financial institutions?

Abe AI enhances customer engagement for financial institutions by providing intelligent, tailored interactions through its Virtual Financial Assistant and Conversational AI Platform. These solutions proactively guide customers with personalized interactions, allow self-serving capabilities, and support multiple languages and channels. This results in increased engagement, improved user experiences, and the development of robust customer relationships.

How does the Conversational AI Platform by Abe AI work?

Abe AI’s Conversational AI Platform is a comprehensive solution that enables financial institutions to leverage AI for better operational efficiency and customer experiences. This platform comes with fully featured products that can be used for robust dialogue creation, compliance tracking, and smooth funds transfer. The Conversational AI Platform can also be customized based on the institution’s unique requirements.