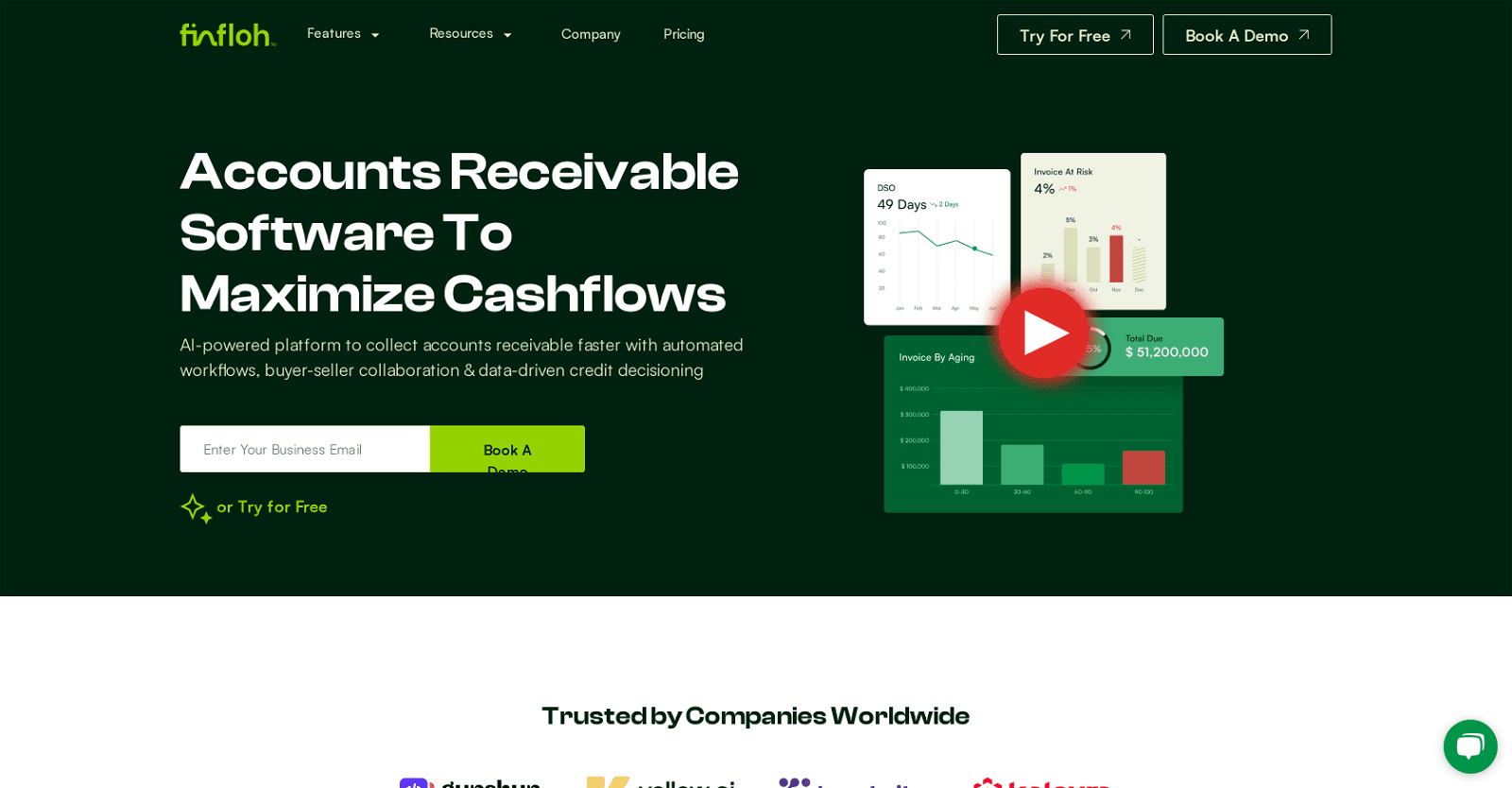

FinFloh is an accounts receivables (AR) automation software designed to streamline AR operations and enhance collections efficiency. Powered by AI, this tool automates multi-channel follow-ups tailored to the buyer’s credit risk and payment behavior.

It provides a collaborative platform that fosters closer communication between buyer and seller teams, expediting dispute resolution and accelerating payments.

With an automated cash application feature, FinFloh enables rapid invoice-cash reconciliation, reducing manual effort and errors. It stands out for its integration of buyer intelligence and data-based credit decisions, empowering informed credit decisions and cash flow forecasting.

FinFloh simplifies integration with other platforms, establishing a centralized data hub for seamless AR management. Moreover, it prioritizes data security by complying with SOC 2, GDPR, and ISO standards.

More details about FinFloh

How does FinFloh streamline the AR process?

FinFloh streamlines the AR process by automating tasks like cash application and follow-ups. Its automated cash application swiftly reconciles invoices with payments, reducing manual effort and errors. The AI-powered multi-channel follow-up system adjusts tone and frequency based on buyer credit risk and payment behavior.

How does FinFloh incorporate buyer intelligence into credit decisions?

FinFloh leverages buyer intelligence by analyzing market insights and receivables data. This allows users to make informed credit decisions and tailor contracts using AI. Predictions for payment and cash flows are based on real data and trends, enhancing credit decision-making.

What data does FinFloh use to customize its approaches?

FinFloh utilizes buyer credit risk, payment behavior, and receivables data to customize its approaches. This data informs automated follow-ups, facilitates accurate credit decisions, and predicts future payments and cash flows effectively.

What is FinFloh’s automated cash application feature?

FinFloh’s automated cash application feature swiftly reconciles invoices with payments, ensuring same-day processing. By automatically matching incoming payments with invoices, it minimizes manual effort and reduces errors. This feature optimizes resource allocation and allows teams to focus on strategic tasks.