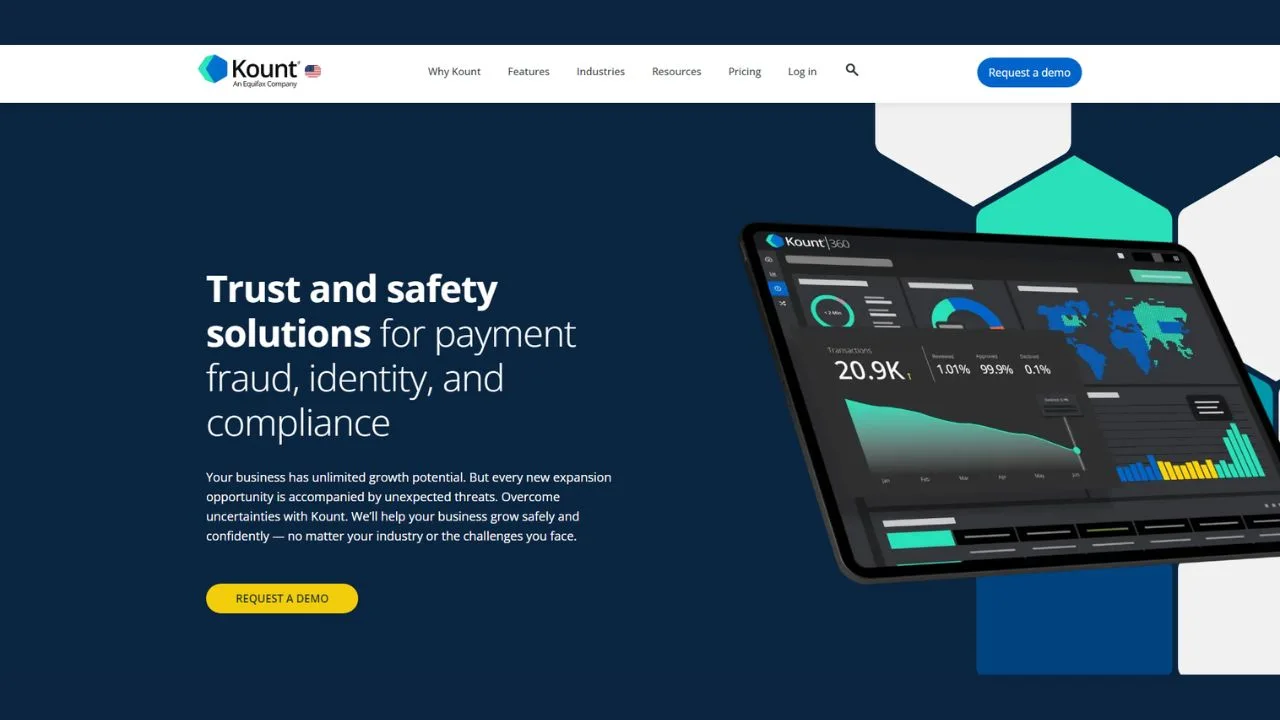

Kount AI offers a comprehensive solution to these problems, ensuring that companies can grow safely and confidently. By leveraging advanced technology, Kount AI helps businesses manage fraud and chargebacks across the entire customer journey.

Kount AI builds detailed personal profiles using hundreds of data points, such as buying habits and payment history. This allows businesses to fully understand who is interacting with their brand. With this information, companies can engage the right customers at the right time, providing a secure yet satisfying experience.

One of the standout features of Kount AI is its ability to simplify compliance with industry rules and government regulations. Whether it’s anti-money laundering (AML) or know your customer (KYC) requirements, Kount AI ensures businesses meet these standards efficiently, minimizing friction for end users.

Kount AI’s platform is designed to stop fraud before it impacts the bottom line. By combining physical and digital data, it offers unparalleled protection against various threats, including account takeover attacks and promo fraud. This proactive approach helps safeguard businesses at every stage of the customer journey.

The flexibility of Kount AI’s platform is another key advantage. It automates fraud prevention while keeping businesses in control. Whether it’s protecting accounts or managing disputes, the system learns and adapts to new threats, giving companies a significant edge in the fight against fraud.

Thousands of brands worldwide trust Kount AI to ensure safe and secure interactions. By providing robust fraud protection without compromising the customer experience, Kount AI enables businesses to grow with confidence.