PennyFlo stands out as an all-encompassing AI-powered financial solution tailored to manage, streamline, and automate cash flow operations for SMEs, startups, and freelancers.

This comprehensive tool seamlessly integrates with your bank accounts, facilitating vendor payments, receipt of payments, and effortless reconciliation. Notable features include cash forecasting and cost control & budgeting functionalities.

Cash Forecasting empowers users to visualize their cash flow for upcoming scenarios, enabling informed decision-making. The Cost Control & Budgeting feature tracks financials and provides oversight on spending, promoting team collaboration and direct cash management.

Moreover, PennyFlo offers Connected Banking, facilitating seamless integrations and centralized management of bank accounts, accounting platforms, and payment gateways within a single workspace.

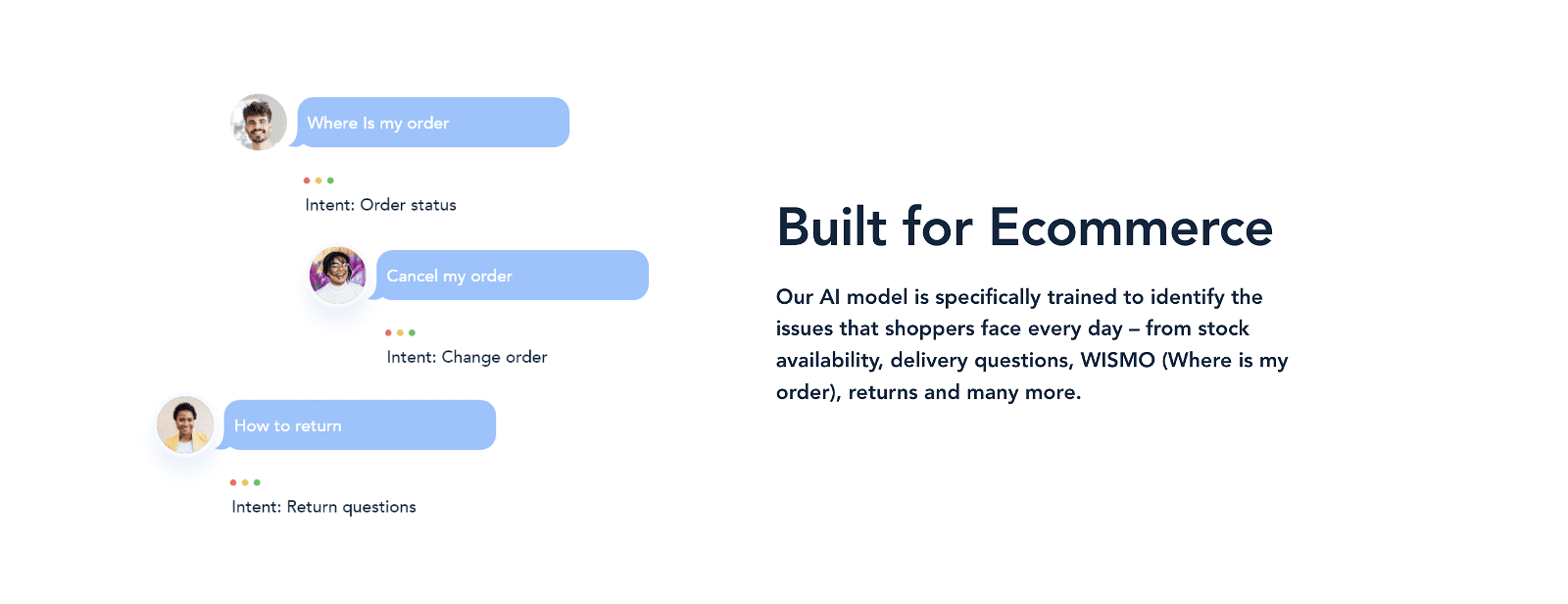

The tool automates payments, collections, and reconciliations, mitigating the risk of errors irrespective of the volume of transactions. Additionally, PennyFlo includes innovative offerings such as PennyPay, an AI-powered payment gateway, and PennyCollect, designed to expedite collections and reduce instances of late payments.

With a core focus on making cash flow the cornerstone of financial management, PennyFlo presents an all-in-one solution for enhancing and sustaining a profitable business venture.

More details about PennyFlo

What are PennyPay and PennyCollect?

PennyPay and PennyCollect are distinct offerings within PennyFlo’s suite. PennyPay serves as an AI-powered payment gateway, streamlining payment processes and reconciliations through automation. Conversely, PennyCollect is tailored to expedite collections and minimize late payments through automated functionalities.

How does PennyFlo support cash forecasting?

PennyFlo’s Cash Forecasting leverages AI to visualize near-future cash flow scenarios. This dynamic forecasting capability empowers users to plan ahead and make well-informed decisions. It centralizes cash flow insights within a single workspace, facilitating organized management across different forecast scenarios.

What integrations does PennyFlo offer?

While specific integrations are not explicitly outlined on PennyFlo’s website, the platform emphasizes facilitating seamless integrations for “Connected Banking.” This suggests compatibility with major banks, accounting platforms, and payment gateways to streamline financial management processes.

How does PennyFlo manage cost control and budgeting?

PennyFlo empowers users with robust cost control and budgeting features by tracking financials and providing oversight on spending. It enables direct cash management and fosters team collaboration, allowing businesses to manage budgets effectively as they scale. Additional features such as employee budgeting, customizable dashboards, and streamlined approval workflows further enhance spending control capabilities.