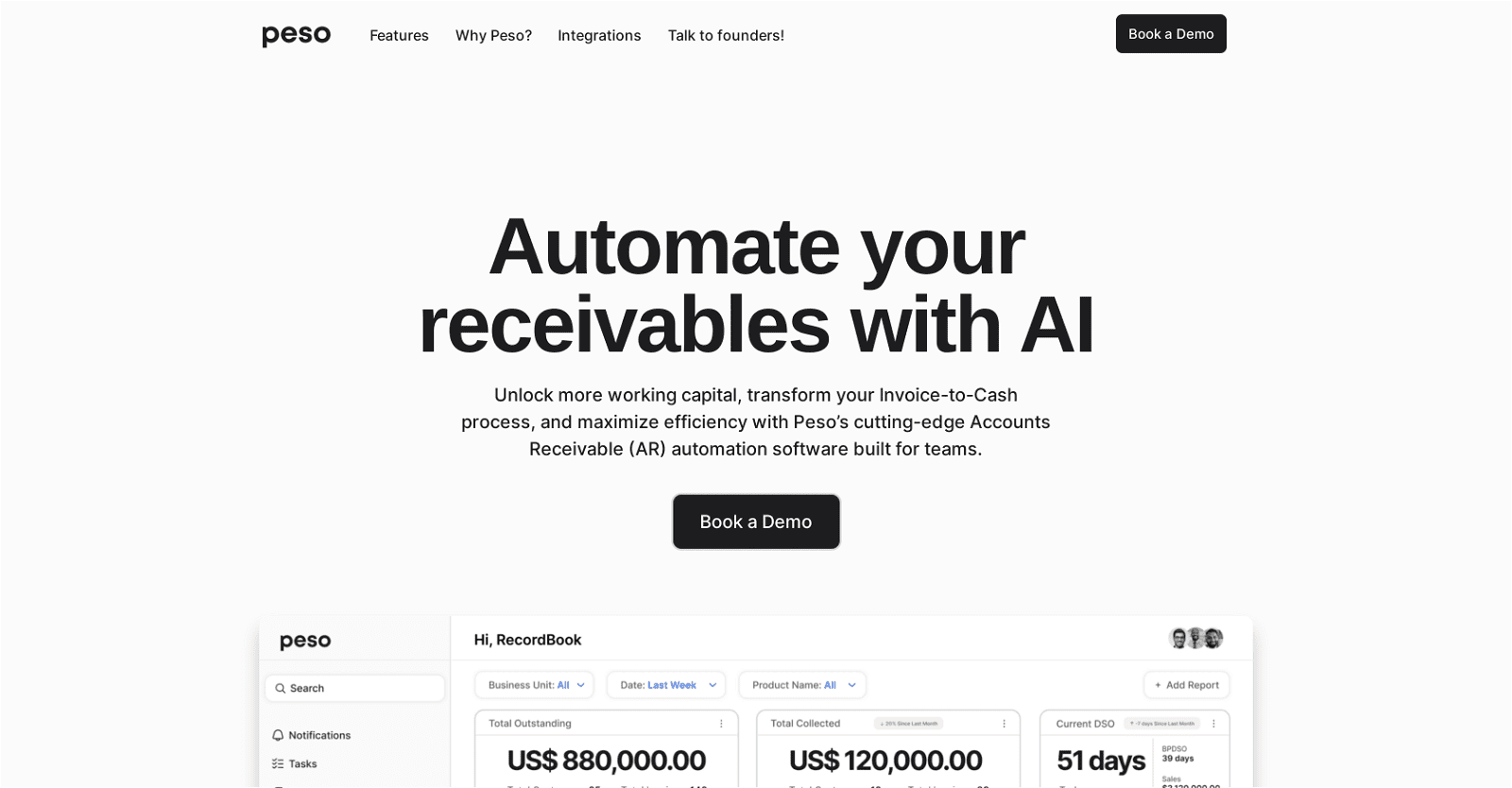

Peso, an Accounts Receivable (AR) Automation Software, accelerates debt collection, optimizes cash inflow, and streamlines AR processes. Its core functionalities include automating invoice-to-cash procedures, potentially unlocking additional working capital, enhancing efficiency, and fostering personalized customer experiences through strategic collection planning.

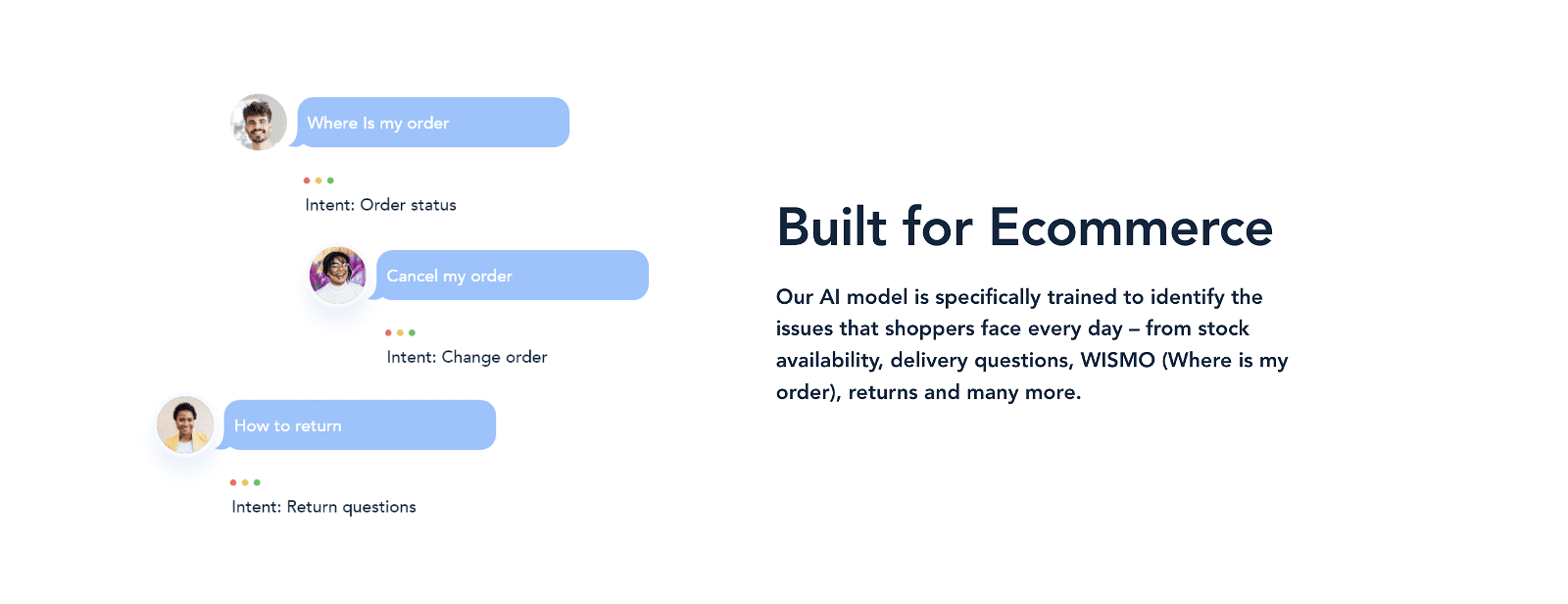

Businesses leverage Peso to segment customers and tailor collection strategies for each segment. Automated follow-ups and responses capture further enhance efficiency while maintaining a personalized touch. Peso also facilitates enhanced team collaboration, fostering communication across finance, sales, and customer success teams and enabling seamless workflow integration across preferred tools.

Real-time AR tracking is a pivotal feature, empowering businesses to monitor cash flow closely and identify potential bottlenecks for consistent cash inflow. Advanced features, such as real-time data integration with Salesforce, offer automatic syncing for enhanced operational efficiency.

Moreover, Peso provides comprehensive reporting insights on collections, cash flows, historical Days Sales Outstanding (DSO) trends, and other receivables process metrics. By leveraging these insights, businesses can optimize their receivables processes and make data-driven decisions.

Designed for ease of integration, Peso seamlessly syncs with existing finance and sales tech stacks, promoting centralized operations and smoother workflows.

More details about Peso

Can Peso devise tailored collection strategies for each segment?

Yes, Peso excels in crafting customized collection strategies for individual customer segments. These tailored approaches significantly enhance the efficacy of debt collection efforts, foster personalized customer interactions, and ultimately lead to improved financial outcomes for the business.

What are the benefits of Peso’s automated follow-ups?

Peso’s automated follow-up system streamlines customer interactions effectively. By automating follow-up procedures, it eliminates the risk of missed or delayed follow-ups, thereby enhancing the efficiency of collection processes.

What is the role of Peso in customer segmentation?

Peso empowers businesses to segment their customers into distinct groups. This segmentation forms the basis for crafting customized collection strategies for each segment, facilitating a more personalized and effective approach to debt recovery.

What does Peso do?

Peso, an Accounts Receivable (AR) Automation Software, expedites debt collection, boosts cash inflow, and streamlines AR processes. By automating invoice-to-cash procedures, it has the potential to release additional working capital and enhance overall efficiency.