TaxPilot is an AI-powered platform dedicated to simplifying and improving tax solutions, featuring two primary tools: TaxPro and TaxSummary. TaxPro combines professional expertise with AI efficiency to deliver actionable tax advice grounded in real-world application.

By integrating insights from accounting professionals worldwide with AI capabilities, TaxPro provides precise tax solutions across various tax types and jurisdictions. It also facilitates connections with accountants tailored to users’ specific needs for personalized consulting.

On the other hand, TaxSummary streamlines tax information by synthesizing and summarizing updates from diverse online sources. This tool saves users valuable time by offering essential tax knowledge in a concise format, allowing for quick understanding of key updates and insights related to their interests.

TaxPilot supports content in various formats including text, links, videos, blogs, and PDFs, and provides easy online management of summarized content. By combining professional expertise with advanced AI technology, TaxPilot ensures accurate, practical, and reliable tax solutions for users.

More details about TaxPilot

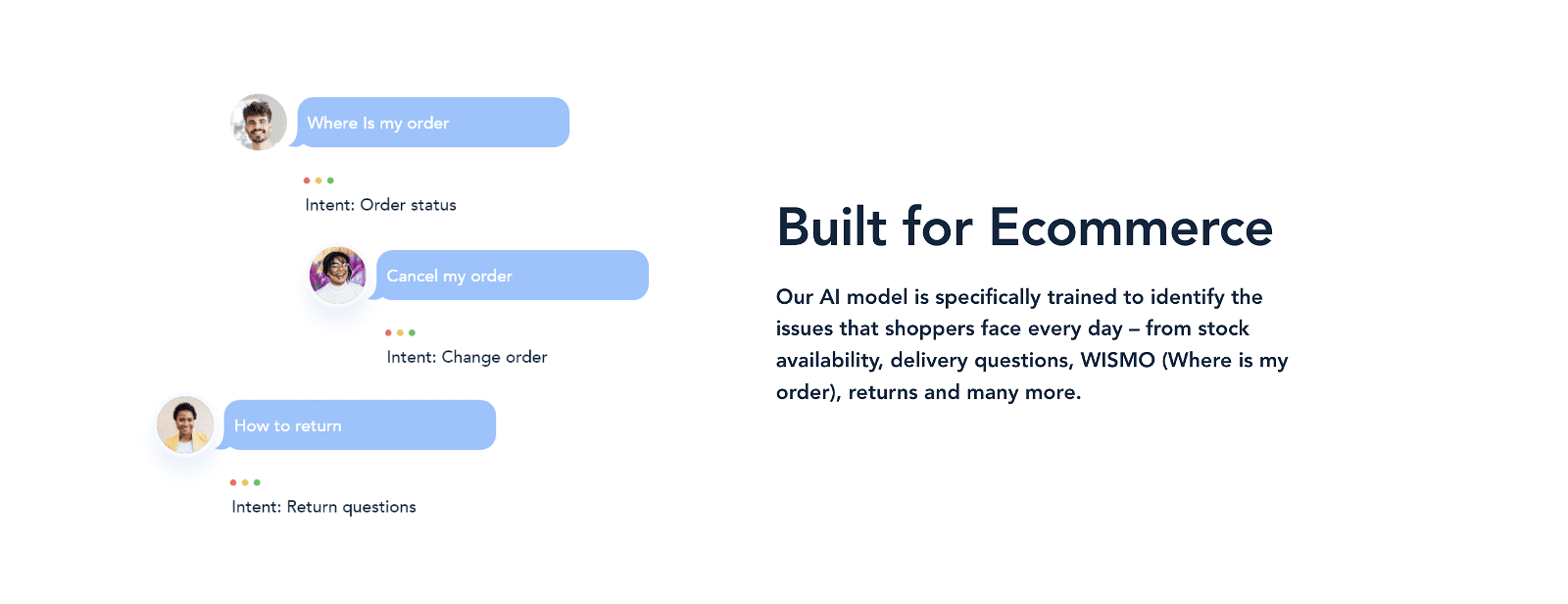

How does TaxSummary in TaxPilot summarize tax updates?

Using artificial intelligence (AI), TaxSummary in TaxPilot swiftly synthesizes tax information from multiple internet sources to summarize tax updates. The summary helps customers rapidly understand important tax updates and insights by outlining the key elements they need to understand.

What features does TaxPro tool offer in TaxPilot?

The TaxPro tool in TaxPilot combines the efficiency of AI with the knowledge of international accountants to deliver precise and workable tax solutions that are ready for use. In addition to covering a wide range of tax situations and jurisdictions, it also attempts to convert expert knowledge into AI efficiency by connecting users with qualified accountants for individualized consultation and providing excellent, useful tax advice. In addition, TaxPro assists with a variety of tax compliance issues, such as corporate tax, capital gains tax, sales tax, VAT, GST, and income tax.

Is the tax advice provided by TaxPilot actionable and practical for everyday scenarios?

Absolutely, TaxPilot’s tax advise is useful and applicable to real-world situations. The TaxPro tool provides accurate, well-founded, and application-ready tax solutions. Users are provided with trustworthy information to enable them to make informed tax decisions through the merger of AI efficiency and professional knowledge.

How does TaxPilot ensure the accuracy of the tax solutions provided?

With its TaxPro tool, TaxPilot combines the knowledge of accounting professionals across the globe with state-of-the-art artificial intelligence to guarantee the correctness of the tax solutions it offers. The combination of effective AI processing and real-world professional insights yields tax solutions that are accurate, useful, and application-ready in addition to being founded on current laws and practices.